Navigating the trends of the US real estate market in 2023 required strategic consideration! Sellers found an advantage with digital tools and kept a vigilant eye on interest rates, while buyers accessed online resources to discover attractive deals. This interplay of factors shaped a market where technological integration, demographic shifts, and economic considerations blended to define the real estate experience in 2023. This report provides a summary of Properstar 2023 leads activity in the United States and a snapshot of the real estate market in general.

United States real estate market in 2023

The US real estate market was shaped by a confluence of influential factors, creating a dynamic landscape for buyers, sellers, and investors alike. Demographics, (with elements such as age, income, and regional preferences), emerged as determinants that influenced home prices and demand. Notably, the tech-savvy tendencies of millennials fueled an increased reliance on online real estate databases and social networks, like Properstar! The repercussions of the COVID-19 pandemic continued to manifest a shift from urban centers to suburban havens, driven by affordability and safety—a trend projected to endure for the next several years.

Fluctuations in interest rates assumed a central role in real estate market dynamics, with lower rates early in the year acting as magnets for buyers, which ultimately drove prices up. Homeowners, motivated by the appreciation of their property values, experienced a buoyant market despite the broader challenges.

Let’s take a closer look at some of the main drivers in the real estate market for the year.

Key considerations in the US real estate market

The US real estate market underwent a dynamic interplay of factors with notable shifts in sales, prices, and mortgage interest rates in 2023. Here are some main considerations of the real estate market in 2023:

Sales: In 2023, existing-home sales reached a 28-year low, recording only 4.09 million sales, a significant 7.3% decline from the previous year and representing the lowest annualized figure since August 2010. 1

Prices: Despite the decline in sales, median home prices surged to a historic high of $389,800 in 2023, reflecting a substantial 4.5% increase from the previous year. This upward trend was primarily attributed to a shortage of available homes, contributing to a surge in prices. 2

Interest Rates: Starting in March 2022, the housing market faced the impact of higher interest rates as the Federal Reserve raised short-term rates eleven times over 16 months – a move aimed to curb economic growth and reduce inflation. Consequently, mortgage rates surged, leading to higher monthly payments for home buyers. The convergence of elevated mortgage rates, unseen in years, and soaring home prices created unusual conditions that complicated the dynamics of the housing market. 3

Inventory: The scarcity of homes for sale played a pivotal role in the escalating prices. By the end of September 2023, the national median home price experienced minimal 0.41% growth compared to the preceding month. 4

Overall, sellers capitalized on the high prices and scarcity of available homes to demand premium rates for their properties. On the other hand, buyers navigated the competitive conditions wisely, anticipating potential price increases. Investors eyeing the real estate sector in the US, remained cautious about potentially lower returns due to the prevalent high-interest rate environment.

Housing prices in the United States

In 2023, home prices in the United States exhibited fluctuations influenced by many economic factors. The median home sales price reached $431,000 in the third quarter, reflecting a 4% increase from the second quarter. The U.S. House Price Index reported a 3.1% rise from April 2022 to April 2023, with regional variations in housing market dynamics.

Affordability challenges intensified, due to high mortgage rates, soaring home prices, and historically low housing stock. Despite a record-high 8.5% increase in median home prices in the second quarter, there was a slight year-over-year dip by 2.4% to $402,600. The overall trend last year, suggests an interplay of regional dynamics, economic policies, and demand. 5

Properstar lead activity

What has been happening on Properstar platform? In the following sections, we'll explore Properstar lead activity for properties on the market across the country. Whether you're considering buying, selling, or simply interested in the industry, this analysis aims to give a clear understanding of market trends on our platform.

Leads based on price range, in popular regions

This chart shows the lead activity for properties for sale in top regions of the United States, by price range. The highest occurrence of leads activity for luxury-priced properties occurs in the Hawaii Islands and California. Areas to watch for more affordable homes are found in New York or Texas. These locations are appealing to investors with their thriving economies, continuous population growth, more attractive rental rates and a strong rental market.

Lead activity based on price for properties for sale in 2023 10

| Region | 250K - 399K USD | 400K - 699K USD | 700K - 999K USD |

| Florida | 0.9% | 9.9% | 1.9% |

| California | 4.5% | 6.1% | 6.1% |

| New York | 13.8% | 12.5% | 4.1% |

| Texas | 16.1% | 9.1% | 1.3% |

| Massachusetts | 1.4% | 16.4% | 10.0% |

| Hawaii | 1.7% | 9.2% | 5.0% |

| Ohio | 5.3% | 1.8% | 0.9% |

Median prices in the US, 2023

The variation over the past year, for houses and apartments for sale on Properstar in top locations is as follows:

Median price variations 10

| City | Apartment | House |

| Miami, FL | 12% | 43% |

| Los Angeles, CA | 9% | -2% |

| NYC, NY | -3% | 13% |

| Houston, TX | -12% | -1% |

Variations in house prices can be attributed to a complex mix of factors. Urban centers differ in terms of economic opportunities, job markets, and overall economic health, influencing demand for housing. Differences in population density, amenities, and infrastructure development contribute to the attractiveness of a particular location, affecting property values. Then there are regional economic policies, government regulations, and local market conditions that further shape the real estate landscape.

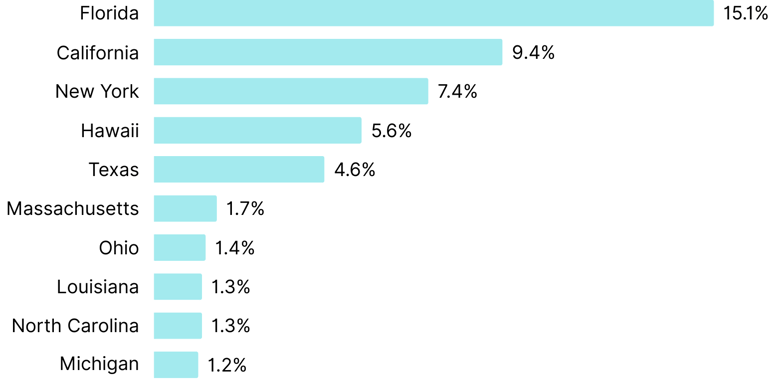

Top regions of interest for US property

Here is the summary of the top regions of searches for US properties on Properstar platform, both for sale and for rent in 2023.

Top regions of interest 10

Type of property searches

Overall, 55% of our leads searched for US homes for sale, while 45% searched for properties for rent in 2023; a slight difference of only 3.2% compared to 2022 search habits, where 51.8% searched for property for sale.

Lead activity for property by type in 2023 showed that 62.4% of people were looking for homes for sale, and 24.3% inquired about apartments for sale in the US. The remainder of the leads were for commercial or land purchase inquiries.

Market watch: On Properstar portals, 2023 saw an increase of 5.8% more leads (for rent and for sale) than in 2022.

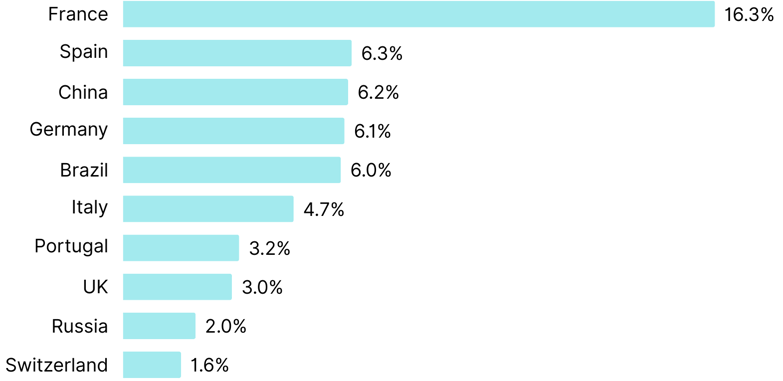

Foreign buyers in the United States

Foreign clients played a notable role in the US real estate market in 2023, constituting 13% of all buyers in the US real estate market, contributing a substantial $13.6 billion in total expenditures. According to the National Association of Realtors in the United States, (NAR) leading the foreign buyer pool were Mexico, Canada, India, and Colombia, each accounting for 7% of the total foreign buyers. The following charts indicate Properstar lead activity.

Top foreign buyers in the US, 2023 10

In the US, our analysis reveals that 88% of leads generated from foreign buyers express interest in properties below the 1M$ threshold. This figure shows a diverse range of preferences and financial capacities among international investors. Contrary to the stereotype of foreign buyers exclusively pursuing luxury real estate, the reality on Properstar platform is that a significant portion of foreign buyers seek properties within a more accessible price range.

Market insight: In the USA, our analysis reveals that only 12% of leads generated from foreign buyers express interest in properties above the 1M$ threshold.

This insight not only challenges outdated perceptions about foreign buying activity, but also informs strategic decision-making. Real estate agencies can tailor their marketing strategies and client engagement to better cater to the needs of foreign buyers across a spectrum of budgetary considerations.

Main regions of interest to foreign buyers

Let's explore the regions in the United States that attract interest from foreign buyers, categorized by the country of the lead.

Foreign buyer interest by country, 2023 10

France |

Spain |

|||

|

Region |

% | Region | % | |

|

Los Angeles |

15.0% |

Alicante | 2.0% | |

|

Miami-Dade County |

10.6% |

Santa Cruz | 0.9% | |

|

New York County |

5.3% |

Málaga | 0.4% | |

|

Orange County |

3.7% |

Tarragona | 0.3% | |

|

Cuyahoga County |

3.2% |

Girona | 0.3% |

China |

Germany |

|||

|

Region |

% | Region | % | |

| Vernon Parish | 11.7% | Los Angeles County | 11.9% | |

| Los Angeles County | 8.3% | Miami-Dade County | 11.9% | |

| Orange County | 7.2% | New York County | 7.0% | |

| Miami-Dade County | 3.8% | Orange County | 6.3% | |

| Harrison County | 3.4% | Honolulu County | 4.9% |

Luxury real estate in the United States, 2023

The top end of the luxury real estate market in the United States, (characterized by sales over $1 million), experienced a slight downturn in 2023 compared to previous years. Despite challenges in various regions of the US, some areas maintained their allure for high-end buyers. Naples, Florida, demonstrated resilience in its luxury real estate market following Hurricane Ian in Sept. 2022. The priciest real estate transaction of 2023 occurred in Port Royal, SC. Despite an overall slowdown in the super luxury sector, certain regions, such as Aspen and Port Royal demonstrated robust sales, reflecting a mix of market conditions.6

Market Watch: Aspen, CO, remained a seller's market due to limited supply and restricted new development although there was a decline in home sales.

As the luxury real estate market transitions into 2024, let us consider ongoing trends. Here are some of the notable luxury market trends in 2023:

Market Dynamics: Shift to smaller homes in the luxury market reflect a changing preference in the luxury real estate market, as well as pricing increases.

Globalization: The luxury real estate market is becoming more globalized, attracting international buyers despite economic concerns.

Price Trends: Median prices for large market luxury homes are on the rise, with a higher percentage of homes listed at $1 million or higher. Cash transactions are becoming more prevalent, influenced by higher interest rates.7

Interest Rate Impact: Rising interest rates are causing some buyers to delay luxury home purchases, with 35% expressing hesitation due to these changes.8

Second Home Ownership: The pandemic has led to an increasing trend in luxury second home ownership, as altered work dynamics make second homes appealing as financial investments.8

Real Estate Tech: Technology is anticipated to play a pivotal role in shaping the future of luxury residential real estate, as industry experts emphasize it has a significant impact.

Luxury leads by region, 2023 10

| Region | 1M - 2.49M USD | > 2.5M USD |

| Florida | 5.1% | 6.9% |

| California | 15.2% | 33.9% |

| New York | 11.4% | 12.5% |

| Texas | 2.7% | 4.6% |

| Massachusetts | 15.7% | 4.3% |

| Hawaii | 8.4% | 7.6% |

| Ohio | 8.8% | 1.8% |

Some ongoing trends, such as the influence of technology, globalization, and evolving buyer preferences will continue to shape the market as we move into 2024. Monitoring these factors will provide a more accurate understanding of how sales activity may unfold in the upcoming year.

Let’s take a look where foreign luxury buyers are buying in the United States by country of origin.

Foreign luxury leads by country, 2023 10

France

|

Spain |

|||

| Region | % | Region | % | |

| California | 16.1% | California | 28.6% | |

| Florida | 5.2% | New York | 26.5% | |

| New York | 4.8% | Massachusetts | 12.2% |

China

|

Germany |

|||

| Region | % | Region | % | |

| California | 54.2% | Florida | 28.6% | |

| Florida | 16.7% | California | 25.7% | |

| New York | 6.3% | New York | 17.1% |

What is the real estate forecast for the United States in 2024?

The US real estate market is poised for a positive trajectory in 2024.

Sales Surge: NAR forecasts align with the positive trend, predicting a robust 13% increase in sales and a 4.7% uptick in the average home price.

Favorable Mortgage Rates: The average 30-year fixed mortgage rate is projected to decline, enhancing home affordability and facilitating a more accessible market.

Price Growth: Anticipated growth in the average home price, with a forecasted increase of 4.7% to reach $373,000.9

Buyers will be leveraging declining mortgage rates and anticipating heightened competition, which will affect their offers accordingly. Sellers can capitalize on high buyer interest by promptly listing their homes and by pricing competitively. Homeowners will be exploring refinancing options at lower rates to mitigate high monthly mortgage payments. Additionally, staying informed about real estate news and trends through resources like Properstar, and utilizing our tools such as: house price estimator, price change notifications & AI searchability can position buyers and agents alike, to make informed decisions and optimize their experience.

More About Properstar

Properstar is the largest global property platform in the world and has been connecting sellers and buyers through a large network of qualified agents since 2018. We stand as a global leader in online listing publishing. Collaborating with over 100 property portals in more than 60 countries, Properstar enables agencies and developers to reach an audience of over 150 million potential buyers and investors.

Join the home-buying evolution!

As your clients embark on the quest for their perfect property, let Properstar go beyond unique preferences, providing tailored listings that align with their aspirations. This revolutionary approach ensures that property searches are not just efficient but extraordinary. Don't miss the opportunity to explore the future of real estate searches and try Properstar's AI-driven platform today to witness the difference firsthand!

Contact us

Sources

1 CNN

4 CBRE

5 Federal Bank Reserve

7 NAR

8 Coldwell Banker

9 Corelogic

10 Properstar